hokeypokey said:

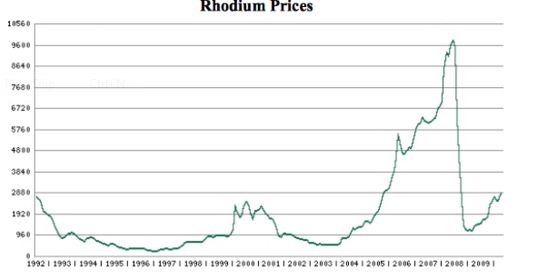

Good advice. I'm thinking that even if it did drop to some crazy low it would definitely rise again. My hopes are to double my investment in one to two years. Maybe even triple or more or lose but that's the gamble in investing I guess. Rhodium just seems different than the other precious metal investments to me. It seems to me that it will always have some serious value. I'm not basing that statement on any education I have just a feeling. I don't know any rhodium buyers so I'm leaning towards sponge that's held in a company's holdings waiting to sell when the time is right. My research tells me that is better than bullion but please teach me what is the right way to go about doing a rhodium investment because I know that I know little in this field. I'm willing to listen and learn.

'

If it did drop to some crazy low number, I'd try to buy some even if it was just for a long term investment. (Like I should have done, when silver was close to $4/Toz back in 1999/2000)

I've never actually invested "yet", because of my lack of funds, but I've been looking at charts/stocks forever :lol: "I was probably about 10 when I first got interested in it"

I also feel that it will always have value. It's for 3-way catalytic converters, nuclear reactors, jewelry, making fiberglass, electronics, for hardening and improving corrosion resistance, X-rays, etc.

Also, what wiki doesn't tell you 8) ,is that it has been "tested" in nanobiotechnology as an anti-tumor treatment for breast cancer, leukemia, and most likely a completely seperate long list of other things that wouldn't be posted online. It has something to do with the K562 cells in bone marrow, so I figure it would probably be used to make different types of medicine in 10 years or so, once all of the testing is finished.

Sponge form sounds like it would be better for trading, since it would be easier for a company to use it, without having to re-melt/dissolve it from bullion/bar form first. I personally like having the actual items, to make sure I know where they are, instead of bouncing around in some (possibly non-existant) form or another between companies, but thats just me.

I'm not sure about investing in Rhodium, but you can buy/sell it on Kitco and many other places online.

I would still probably wait a bit if you did decided to get any, because it's been going down slowly for a while now, but judging by the last 5 years of a pretty steady decline, it could finally bottom out soon. Makes me wanna look into it a bit more.